“Crypto Trade Strategies: Use of Liquid Markets and Effective Convention Mech”

The two main concepts of cryptocurrency trade in the world have become very important success: liquidity and consensus mechanisms. Liquidity means how to easily purchase or sell assets at a favorable price, and consensus mechanisms ensure that operations are carried out efficiently and safely.

Liquidity Crypto Trading

Liquidity is essential for any merchant, but especially in cryptocurrency markets where prices can fluctuate quickly. The liquid market allows traders to quickly and sell the property and at a relatively low price. In the case of cryptocurrencies, liquidity is often provided by decentralized exchanges (DEX) such as Uniswap, Sushiswap and Curve.

These DEX offers a variety of functions that allow merchants to easily achieve liquidity, for example ::

* A couple

: traders can create pores with other assets, allowing them to trade in several markets at the same time.

* Order Route : Liquidity providers’ routes sell between different exchanges or marketplaces, reducing slip and increasing trading volume.

* margling marketing : Trade platforms allow traders to use margin, which allows them to use their positions to increase profits.

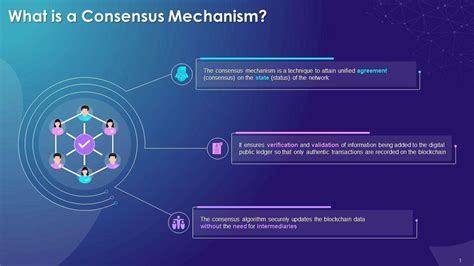

Crypto trading mechanism

The consensus mechanism is an essential aspect of any cryptocurrency exchange. This ensures that surgery is carried out efficiently and safely, preventing malicious actors from manipulating the market. The consensus mechanisms can be divided into several types:

* BOOK proof of work (POW) : The most common type of consensus mechanism when network nodes compete to solve complex mathematical puzzles to confirm operations.

* Promotion of stock (POS) : Energy -saving alternative to POW, when the cleaners are selected based on the amount of cryptocurrency they are considered to be, instead of solving puzzles.

Arbitration strategies

Arbitrage is a trade strategy that exploits price differences between two markets. In cryptor trade, arbitration includes the possibility of buying assets in one market and selling it at a higher price elsewhere. Using liquidity providers and efficient consensus mechanisms, traders can take advantage of these price differences to make a profit.

Example of arbitration strategy

For example, let’s say we want to sell Bitcoin (BTC) on two exchanges: Coinbase Pro and Binance. We set the following price difference:

- Coinbase Pro, BTC sells $ 40,000

- Binance BTC sells $ 42,500

We can then use liquidity providers to buy BTC Coinbase Pro for $ 39,500 (current market price) and sell it for $ 42,500. In doing so, we created the possibility of arbitration:

profit:

- Sell for $ 40,000 (Coinbase Pro)

- Purchase for $ 39,500 (profitable trade)

- Sell for $ 42,500 (Binance)

This $ 1500 profit means a return on investment in 3.8%.

Conclusion

In conclusion, the mechanisms of liquidity and consensus are the main components of successful cryptocurrency trading strategies. Using the benefits of decentralized exchange, evidence of work or evidence of work, and the effective arbitration strategies, traders can make reasonable decisions and use price differences to achieve success in the cryptocurrency market. As the cryptocurrency world progresses, it is very important for traders to constantly update the latest changes and apply their strategies accordingly.

Leave a Reply