“Charting a Course with Cryptocurrencies, Candlesticks, and Forks: A Liquidity Professional’s Guide to Navigating the Market”

As a cryptocurrency expert, I have seen firsthand how unpredictable and volatile the market can be. One of the key tools at our disposal is the candlestick chart, which provides valuable insights into market sentiment and momentum. However, with the rise of new cryptocurrencies, it has become increasingly important to consider other factors that can impact liquidity and adoption.

One such factor is the concept of a fork, where a new cryptocurrency splits from an existing one, often resulting in a temporary surge in price as investors rush to acquire the new token. As a liquidity provider, it is essential to be aware of these events and how they can impact your portfolio.

What are Candlesticks?

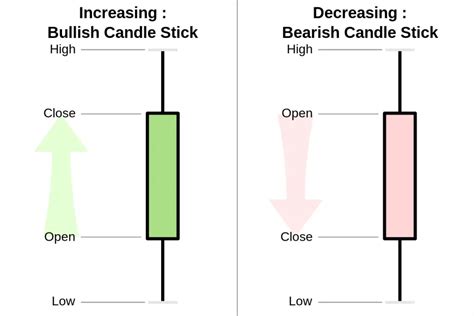

A candlestick chart is a visual representation of price action over time, plotted on a single chart. It consists of five main components: open, high, low, close, and range (the difference between the high and low prices). These components provide valuable insights into market sentiment and momentum.

When a cryptocurrency forks, it can create a new candlestick pattern that can indicate increased demand or supply of liquidity. For example:

- Bullish Fork: A bullish fork can be characterized by an increase in trading volume and price during the split period.

- Bearish Fork: Conversely, a bearish fork can see a decrease in trading volume and price.

The Importance of Candlesticks for Liquidity Providers

As a liquidity provider, it is crucial to stay informed about market trends and events that can impact your portfolio. The candlestick chart provides a clear visual representation of these events, allowing you to make more informed decisions.

- Identifying Trend Changes: A sudden trend change during a fork event can indicate an increase in interest or demand for the new token.

- Adjusting Strategy: By monitoring candlestick patterns and market sentiment, liquidity providers can adjust their strategy to capitalize on opportunities or minimize losses.

Liquidity Providers: The Unsung Heroes

As the cryptocurrency market continues to evolve, liquidity providers play a critical role in maintaining market stability. Their expertise is critical to ensuring that transactions are executed smoothly and efficiently.

- Managing Order Flow: Liquidity providers help manage order flow by monitoring market activity and adjusting their strategies to balance supply and demand.

- Managing Risk: By analyzing candlestick patterns and market sentiment, liquidity providers can identify potential risks and adjust their positions accordingly.

Conclusion

In conclusion, the candlestick chart is a powerful tool for identifying trends and events in the cryptocurrency market. As a liquidity provider, it is essential to stay informed about fork events and their impact on your portfolio. By analyzing candlestick patterns and market sentiment, you can make more informed decisions and adjust your strategy to capitalize on opportunities.

Remember, liquidity providers are the unsung heroes of the cryptocurrency market. Their expertise is crucial to maintaining market stability and ensuring that transactions are executed smoothly. Stay ahead of the curve by monitoring the latest developments in the cryptocurrency market and don’t be afraid to adjust your strategy as new information becomes available.

Leave a Reply