The World of Cryptocurrency and Spot Trading: Everything You Need To Know

In recent years, the world of finance has been transformed by the emergence of cryptocurrency. Cryptocurrencies are digital or virtual currencies that use cryptography for security and decentralized control. The most well-known cryptocurrency is bitcoin, but there are many others like ethereum, Litecoin, and Monero. Spot trading is a popular form of cryptocurrency investing where you buy and sell cryptocurrencies with REAL-World Currencies.

What is spot trading?

Spot Trading Involves Buying or Selling Cryptocurrencies at the Current Market Price (Spot Rate) for a Specific Period of Time (Usually Day). In contrast to forward contracts which are used to hedge against currency fluctuations, spot trades directly exchange one asset with another. When you buy a cryptocurrency in a spot trade, you are essentially exchanging it for a real-world currency like us dollars.

Types of Spot Trading

There are severe types of spot trading in the Cryptocurrency Market:

- Market Making : Market Makers Provide Liquidity to the Market by Buying and Selling Cryptocurrencies at prevailing market prices.

- Over-the-fairness (OTF) : OTF platforms allow investors to buy and sell cryptocurrencies with Reall-World Currencies, often at a competitive rate.

- Cryptocurrency Exchanges : Exchanges like Coinbase, Binance, and Kraken Offer Spot Trading Services Where You Can Buy and Sell Cryptocurrencies.

- Leveraged Trading : Leveraged Trading Involves Using Borrows Money or Margin Accounts to Amplify Your Investments.

Benefits of Spot Trading

- Lower risk

: Compared to futures or options trades, spot trading is considered a lower-risk investment as there’s no leverage involved.

- FLEXIBILITY : Spot trading allows you to buy and sell cryptocurrencies at any time, without having to wait for market hours.

- Real-time price action : You can see the current price action in real-time, which helps with decision-making.

Risks of Spot Trading

- Market volatility : Cryptocurrency prices can fluctuate rapidly, making it difficult to predict future prices.

- Liquidity Risks : Market Makers may not always be available, or their Liquidity might be limited, leading to price volatility.

- Regulatory Risks : Governments and Regulatory Bodies are actively working to restrict cryptocurrencies, which could impact market demand.

How to Start Spot Trading

- CHOOSE A Cryptocurrency Exchange : Research Reputable Exchanges Like Coinbase, Binance, or Kraken that Offer Spot Trading Services.

- Familiarize yourself with the platform : Understand how to use the platform’s interface and learn about the fees associated with spot trading.

- Set Realistic Goals : Define your investment goals and risk tolerance before starting spot trading.

tips for successful spot trading

- Educate Yourself : Continuously Learn About Cryptocurrency Market Trends, Prices, and Regulations.

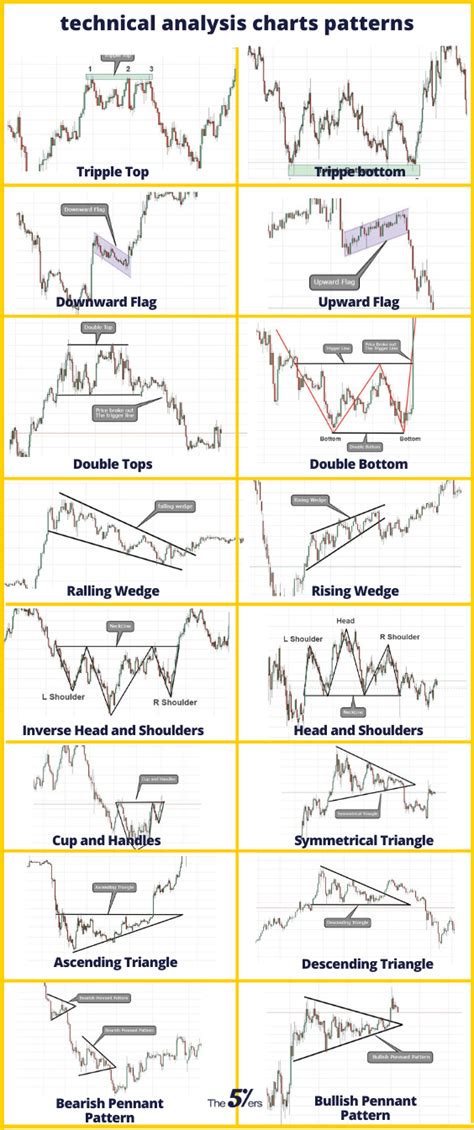

- Use a Trading Platform : Choose a platform that offers real-time price, technical indicators, and order types like Limit Orders or Market Orders.

- Start with Small Positions : begin with small trades to manage risk and increas your confidence level.

Conclusion

Spot trading is an exciting way to invest in cryptocurrencies, offering the flexibility of buying and selling at any time. However, it’s essential to understand the risks involved and be aware of the regulations that are changing rapidly in this space. By following our guide, you’ll be better equipped to navigate the World of Cryptocurrency Spot Trading and Make Informed Investment Decision.

Disclaimer

This article is for informational purposes only and should not be considered as a financial advice or recommendation.

Leave a Reply