Bullish Market Sentiment: What It Means for Investors

The world of cryptocurrency has experienced significant growth and fluctuations in recent years. While some investors have made a substantial gains, others have lost money. Market sentiment and its implications for investors.

What is bullish market sentiment?

Bullish market sentiment refers to the general feeling investors that a particular stock or asset class is likely to rise in value over time. This In the context of cryptocurrency, bullish market sentiment often translates to investing significant price increases for their holdings.

Characteristics of Bullish Market Sentiment

Define Bullish Market Sentiment in the Cryptocurrency Space:

- Positive Outlook

: Investors have a favorable view of the asset class, expecting it to grow and become more valuable over time.

2.

- Improved fundamentals : Cryptocurrencies Often Exhibit Strong Fundamental Properties, Such as High Transaction Fees, Low Energy Consumption, and Decentralized Governance.

- Growing Institutional Investment : Institutional Investors, such as hedge funs and family offices, are increasingly investing in cryptocurrencies, driving up prices.

Why is Bullish Market Sentiment Important for Investors?

Bullish market sentiment can have a significant impact on the cryptocurrency market as a whole. Some Key Benefits Include:

1.

- Higher Prices :

.

Challenges of Bullish Market Sentiment

While a positive market sentiment can be beneficial, there are also potential challenges to consider:

1.

2.

- Risk of market manipulation :

Investor Strategies

The following Strategies:

1.

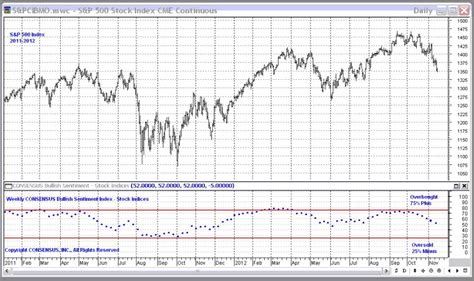

- Technical Analysis : Understanding Technical Indicators and Chart Patterns Can provide

.

Conclusion

Bullish market sentiment is a critical factor that investors should consider when navigating the world of cryptocurrency. While it is essential to be aware of the potential of the potential with bullish sentiment, understanding its significance can also provide profide valuable insights into market trends and opportunities.

Leave a Reply