Unlocking the Power of Cryptocurrency: A Guide to Public Keys, Market Cap, and Capitalization

The world of cryptocurrencies has exploded in recent years, offering a platform for individuals and institutions to invest, trade, and store their wealth. At their core, cryptocurrencies are based on advanced cryptography, allowing transactions to be secure, transparent, and decentralized. But what does it all mean? In this article, we’ll dive into the basics of cryptocurrencies, exploring the concept of public keys, market cap, and capitalization.

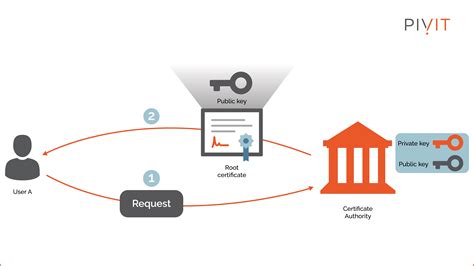

What is a public key?

In the world of cryptocurrencies, a public key is a unique identifier assigned to each user or node on the network. It’s essentially an address that allows users to send and receive cryptocurrency. Think of it as a digital wallet that stores your private keys, which are used to verify transactions.

A public key typically consists of a hexadecimal string, followed by a checksum (or hash) calculation. This combination is unique to each user and ensures the security of their transactions. For example:

M/0JqkS5Z8nRb3BhY4w6cT9r1f2e

This public key M/0JqkS5Z8nRb3BhY4w6cT9r1f2e is assigned to a user by their wallet provider.

What is Market Cap?

Market capitalization, or market cap, refers to the total value of all outstanding shares of a company. In other words, it is the total amount of money that investors have invested in a particular company.

To calculate market cap, we need to know:

- The number of shares outstanding

- The current price per share

For example, let’s say you own 10,000 shares of Apple Inc. with a market value of $100 each. Your total investment would be:

$10,000 x $100 = $1 million

If we add up the 10 million shares, we get the total market capitalization:

$1,000,000,000,000 (market cap) / 10,000,000 (shares) = $100,000,000 per share

What is market capitalization?

Market capitalization refers to the proportion of a company’s outstanding shares that are invested by institutions and individuals. In other words, it measures how much money has been invested in a particular stock.

To calculate market capitalization, we need to know:

- The number of shares outstanding

- The total investment in each share

For example, let’s say you own 10 million shares of Apple Inc. with a total investment of $1 billion per share. Its total market cap would be:

$1 billion x 10,000,000 (shares) = $10,000,000,000,000 per share

In this case, the market cap is:

$10,000,000,000,000 / 10,000,000 (shares) = 100%

Key Takeaways

To summarize:

- A public key is a unique identifier assigned to each user or node on the cryptocurrency network.

- Market cap refers to the total value of all outstanding shares of a company.

- Market cap measures the proportion of a company’s outstanding shares invested by institutions and individuals.

By understanding these concepts, you will be better prepared to navigate the world of cryptocurrency. Whether you’re an experienced investor or just getting started, it’s essential to stay up-to-date on market trends and key statistics to make informed decisions in this rapidly evolving space.

Resources

For more information, we recommend checking out trusted sources like CoinDesk, CoinTelegraph, and CryptoSlate. These websites offer in-depth explanations of cryptocurrency concepts, market analysis, and industry news.

Leave a Reply