The Power of Technical Indicators in Cryptocurrency Trading Success

Cryptocurrency markets have experienced significant growth and volatility in recent years, making them a challenging space to navigate. As a result, traders are constantly seeking ways to improve their chances of success. One effective strategy that has proven to be highlighted is using technical indicators in cryptocurrency trading.

What are technical indicators?

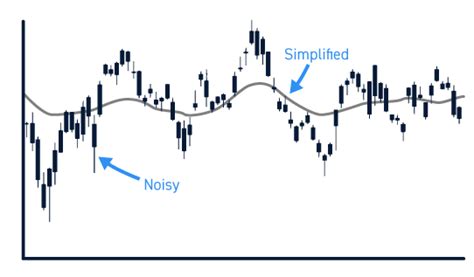

Technical indicators are mathematical calculations used to Analyze Price movements and patternns in financial markets, including cryptocurrencies. These Indicators Provide Valuable Insights Into Market Trends and Help Traders By combining multiple technical industrators with other forms of analysis, traders can fine and comprehensive understanding of the cryptocurrency market.

Types of Technical Indicators

Traders cryptocurrency markets. Some Popular Ones Include:

1.

2.

- Stochastic oscillator

:

- Bollinger Bands :

How to use Technical Indicators in Cryptocurrency Trading

Using technical indicators can be a powerful tool for cryptocurrency traders. Here are some strategies that incorporate technical indicators:

- Identify trends : use mas to identify long-term trends in the market. .

- Monitor RSI and Stochastic Oscillator

: If the RSI is above

- Track volatility : Bollinger Bands can help you monitor price volatility and potential revsals. When

- Use indicator crossovers :

Benefits of using Technical Indicators

Using Technical Indicators in Cryptocurrency Trading Offers Several Benefits, Including:

1.

.

.

Tips for Getting Started

Getting Started with Technical Indicators in Cryptocurrency Trading Requires Patience and Practice. Here are some tips to help you get started:

1.

2.

.

4.

Leave a Reply